The Silent Battle: Why LTD Claims for Invisible Illnesses Are Denied in BC

Fact-checked by Long-Term Disability lawyer Tim Louis

Invisible Illnesses and LTD Denials in BC

If your long-term disability (LTD) claim was denied because of an invisible illness like fibromyalgia, depression, or chronic fatigue, you’re not alone — and you’re not without options.

In British Columbia, LTD claims involving invisible conditions are often rejected due to a lack of “objective” evidence. This guide explains:

- Why insurers deny these claims

- Which conditions are most affected

- How to strengthen your appeal

- When legal support can shift the outcome

If you’re living with a hidden disability and need help, this article is your starting point toward fairness, support, and being truly heard.

Introduction – The Invisible Fight

You’re exhausted. You’re in pain. You’ve seen doctors, followed every instruction, and tried to explain what you’re going through — but because your illness can’t be seen on an X-ray or a scan, your insurer says you’re “not disabled enough.”

That kind of response doesn’t just hurt your claim. It hurts your dignity.

Across British Columbia, people with conditions like fibromyalgia, depression, chronic fatigue, and PTSD are being denied the long-term disability (LTD) benefits they desperately need. Not because they’re not suffering — but because their pain isn’t visible on paper.

This is the silent battle.

And if you’re fighting it, you’re not alone.

Tim Louis has spent over 40 years helping people just like you — people living with invisible illnesses who are tired of being disbelieved. This article will walk you through why these claims are denied, how to push back with power, and what you can do today to protect your rights and reclaim your future.

Why Invisible Illnesses Face Higher LTD Denial Rates

Long-term disability insurers like to see what they can measure. But when your condition doesn’t show up on a blood test or MRI, they often assume you’re exaggerating — or worse, not disabled at all.

This is one of the biggest barriers people with invisible illnesses face when applying for LTD benefits in British Columbia.

The Problem: “You Don’t Look Sick”

Insurance companies rely heavily on what they call objective medical evidence — things they can quantify in black and white: scans, labs, imaging, visible injuries.

But for conditions like fibromyalgia, chronic fatigue, PTSD, and depression, the most debilitating symptoms are often subjective:

- Pain that comes and goes

- Exhaustion that doesn’t show up in a test result

- Mental health struggles that insurers minimize

- Flare-ups triggered by stress, sleep, or environment

And because they can’t “see” it — they don’t believe it.

Insurer Bias Is Built into the Process

Even when you’ve done everything right — doctor visits, medication, therapy, assessments — insurers often:

- Use internal consultants to overrule your family doctor

- Hire “independent” examiners who report back to them

- Suggest you could return to work based on partial function

- Disregard psychological or neurological symptoms as “subjective”

This isn’t about your health — it’s about profit protection.

A Legal Perspective

“In my experience, the issue isn’t whether you’re suffering — it’s whether you can prove it on paper in a way the insurer is forced to respect.”

— Tim Louis, Disability Lawyer

If you’ve received a denial letter that implies you’re not sick enough, or suggests your condition is “non-severe,” know this:

You’re not being denied because you’re not trying. You’re being denied because your disability is harder to see.

And that’s exactly why we fight.

Common Invisible Illnesses That Trigger LTD Denials

When your illness doesn’t show up on a scan, insurers often act like it doesn’t exist. But invisible conditions are real — and they impact thousands of LTD claimants across BC and Canada every year.

Here are some of the most common invisible illnesses that face unfair scrutiny or denial in the LTD claims process:

Fibromyalgia

Characterized by chronic, widespread pain and debilitating fatigue. Insurers frequently deny claims citing a “lack of objective evidence,” despite the very real suffering caused by this neurological condition.

Chronic Fatigue Syndrome (CFS / ME)

This misunderstood illness can leave people unable to function, work, or carry out daily tasks — yet insurers often label it as “unclear” or “inconsistent.”

Depression & Anxiety Disorders

These mental health conditions can be completely disabling. But because they’re invisible, many insurers downplay their impact or treat them as temporary.

Post-Traumatic Stress Disorder (PTSD)

Common among first responders, survivors of abuse, or trauma-related incidents. PTSD symptoms are often questioned unless backed by long psychiatric histories or specific triggers — a high burden for already struggling individuals.

Long COVID

Emerging research shows that post-viral syndromes can result in disabling fatigue, brain fog, and cardiovascular symptoms — yet insurers often label these symptoms as “subjective.”

Autoimmune Conditions (e.g., Lupus, Crohn’s, MS)

These diseases often flare unpredictably and involve internal symptoms like pain, inflammation, and exhaustion. Claims are denied when insurers ignore these cyclical and invisible realities.

If your condition isn’t listed here but you’ve been denied because it’s “not visible,” you’re not alone — and Tim Louis may still be able to help.

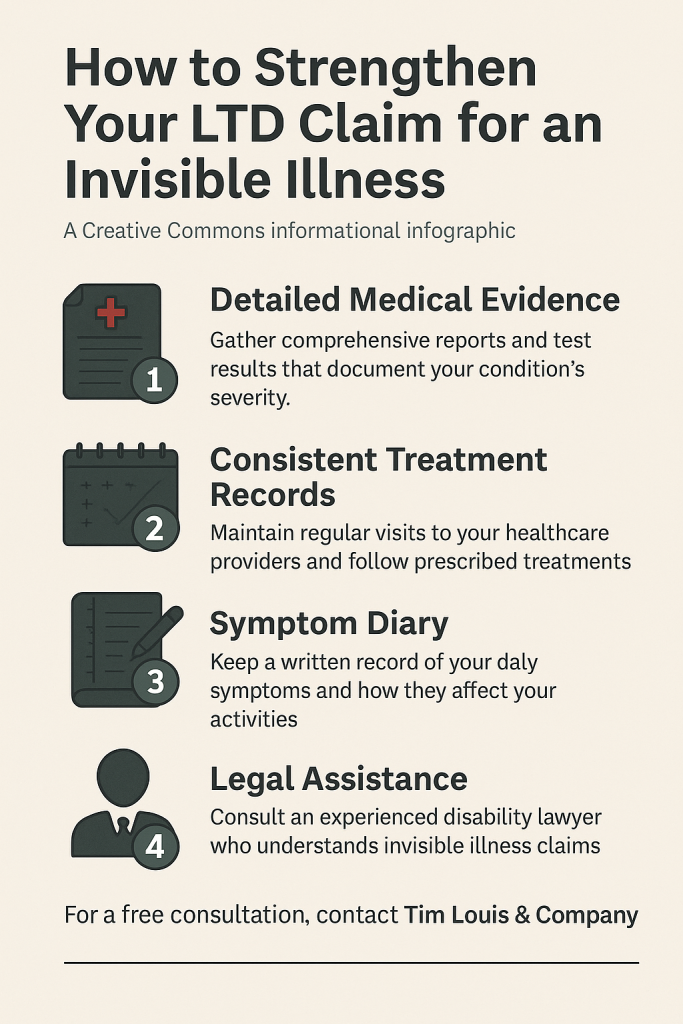

How to Strengthen Your Claim with an Invisible Condition

When your condition isn’t visible, your documentation needs to speak louder than any lab result.

Most LTD denials we see for invisible illnesses aren’t because the person isn’t suffering — they’re because the evidence wasn’t packaged in a way the insurer could (or would) accept.

Here’s how to protect yourself — and build a claim that’s harder to deny.

Checklist: Building a Strong LTD Claim for an Invisible Illness

- Keep a Symptom Journal

Write down your symptoms daily — what you experience, how severe it is, and how it affects your ability to function. A journal shows consistency, progression, and real-world impact. - Get Written Statements from Your Doctors

Ask your physicians to write clear, specific reports. These should explain:

- Your diagnosis

- Treatment history

- Functional limitations (what you can’t do)

- Why you are unable to work

- Stay Consistent with Treatment

Missed appointments or irregular care are often used against you. Even if treatments haven’t worked, your record shows you’re doing your part. - Include Functional Capacity Evaluations (FCEs)

These assessments measure your ability to perform work-related tasks — especially helpful when pain or fatigue isn’t always visible. - Avoid Downplaying Your Symptoms

Insurers pick apart words like “I’m managing” or “some days are better.” Be honest. If you’re struggling to cope, say so. This isn’t about strength — it’s about truth. - Consider Legal Guidance Early

A disability lawyer can help translate your experience into language the insurer respects — before you hit a wall with paperwork or denials.

📥 Need help organizing your next steps?

Download the 7-Step LTD Denial Checklist (PDF)

This guide includes the most important actions to protect your rights after a denial — written by Tim Louis and available free.

“You don’t need to suffer in silence. The right documentation can speak for you — and we can help build it.”

Client Story – “They Finally Took Me Seriously”

Let’s call her Andrea.

She was in her early 50s, living with fibromyalgia and generalized anxiety disorder — two conditions that had stolen her energy, confidence, and ability to work. But when she applied for long-term disability, her insurer said she didn’t meet the definition of “disabled.”

“I didn’t look sick enough. That’s what it felt like. It was humiliating.”

Andrea found Tim Louis after reading dozens of reviews online. She wasn’t sure what to expect, but he returned her call the same day.

Together, they rebuilt her case. Tim worked directly with her family doctor to clarify the invisible limitations her insurer had ignored. He helped her gather updated medical evidence, secure a written statement from a specialist, and document how her illness impacted her daily life.

“He made me feel like I mattered. For the first time, someone actually believed me.”

Within weeks of filing the legal appeal, the insurance company changed its tune. Andrea’s claim was approved — with retroactive benefits.

And more importantly, she got her dignity back.

Why Legal Representation Matters for Invisible Illness LTD Claims

When your disability can’t be seen, the fight isn’t just medical — it’s legal.

Insurers don’t make it easy for people with invisible illnesses to get the benefits they deserve. And trying to navigate their system alone can be overwhelming, exhausting, and emotionally draining — especially when you’re already unwell.

That’s where legal representation changes everything.

What a Disability Lawyer Like Tim Louis Does Differently

- Validates your lived experience — with legal evidence.

Insurers dismiss your condition? Tim translates your daily reality into legal proof they can’t ignore. - Works directly with your doctors.

He helps your physicians craft the right kind of reports — specific, function-based, and aligned with legal definitions. - Reframes your denial.

Instead of you responding to an unfair decision alone, Tim builds a clear, structured appeal that targets the insurer’s weak points. - Protects you from insurer tactics.

From misinterpreted records to biased assessments, a lawyer ensures your voice isn’t drowned out by the insurer’s paperwork.

“The most common thing my clients say is, ‘I felt invisible before I called you.’ My job is to make them seen — and heard.”

— Tim Louis

Want more in-depth support?

Download the Full Guide: “If Your LTD Claim Has Been Denied”

This free guide walks you through every stage of an appeal — including timelines, client stories, and legal tips from Tim Louis.

Next Steps – Protecting Your Rights from Here

If you’ve made it this far, you’ve already done something important — you’ve acknowledged that what’s happening to you isn’t fair. And that matters.

You’re not lazy. You’re not imagining things. You’re dealing with a real illness, and your disability claim should reflect that.

At Tim Louis Law, we believe that invisible conditions deserve visible respect. Whether you’ve been denied LTD benefits or are just starting your application, we’re here to make the process easier, clearer, and more humane.

Here’s what you can do right now:

✔️ Book a free consultation — Tim will speak with you directly, listen to your situation, and help you understand if legal help makes sense for your case.

✔️ Ask your questions — No pressure, no legal jargon. Just honest guidance from someone who cares.

✔️ Take the next step — You don’t have to do this alone. Let’s talk about what might come next — together.

📞 Call (604) 732-7678

🗓️ Or book your free consultation online

“You’ve done your part. Now it’s time to let someone fight for you.”

— Tim Louis

FAQ: LTD Denials for Invisible Illnesses in BC

Can I get long-term disability (LTD) for an invisible illness in BC?

Yes. Conditions like fibromyalgia, PTSD, depression, and chronic fatigue can qualify for LTD benefits in British Columbia — but claims are often denied due to a lack of “objective” medical evidence. Legal support can help present your case in a way insurers are more likely to accept.

Why are LTD claims for invisible illnesses often denied?

Insurers often rely on objective tests like X-rays or bloodwork. Invisible conditions don’t always show up this way, so they’re wrongly dismissed as exaggerated or non-disabling — even when symptoms are severe.

What medical evidence do I need for an invisible illness LTD claim?

Detailed reports from your doctor, consistent treatment records, a symptom journal, and written statements explaining how your condition limits your ability to work. Functional capacity evaluations are also helpful.

How can a disability lawyer help with my invisible illness claim?

A lawyer like Tim Louis can translate your real-world experience into legal proof. He helps gather the right documents, challenge insurer bias, and represent your claim with clarity and strength.

What if my LTD claim was already denied?

You still have options. Many LTD denials can be appealed successfully — especially when handled by a lawyer experienced in invisible illness claims. Tim Louis offers free consultations to help you understand your rights.

Is depression or anxiety enough to qualify for LTD in Canada?

Yes. Mental health conditions can be disabling and may qualify for LTD — but insurers often downplay them. The key is strong documentation, consistent care, and legal support if needed.

What’s the first step if I’ve been denied LTD in BC?

Don’t give up. Start by reading your denial letter closely. Then speak with a disability lawyer to review your situation and decide whether an appeal is the right next step.

How long do I have to appeal a denied LTD claim?

It depends on your policy, but many insurers require appeals within 60–90 days. Missing deadlines can limit your options — so it’s best to get legal guidance as soon as possible.

Do I need a diagnosis to qualify for LTD?

A diagnosis helps, but it’s not everything. Insurers care about how your condition affects your ability to work. If your symptoms are well-documented and disabling, you may still qualify.

How can I contact Tim Louis for help with my LTD denial?

You can call (604) 732-7678 or book a free consultation online. Tim takes the time to listen — and may be able to help you fight back and win the benefits you deserve.

Ready to Take the Next Step?

If you’re living with an invisible illness and your disability claim has been denied — you don’t need to stay stuck.

Tim Louis has helped countless individuals in BC stand up to insurers, get heard, and move forward with dignity.

Whether you’re starting your LTD claim or responding to a denial, we’re here to support you.

📞 Call (604) 732-7678

🗓️ Or book a free consultation online

“We believe invisible illnesses deserve visible respect.”

— Tim Louis

Further Reading & Trusted Resources

Looking to better understand LTD claims and how invisible illnesses are treated under disability law in Canada? These resources offer reliable, lawyer-approved guidance and government-backed insight.

Explore more From Tim Louis

- How to Maximize Your LTD Appeal Success After a Denial

Learn the key steps to take after a denial and how to avoid costly mistakes. - Long-Term Disability Appeals Lawyer in Vancouver

Tim Louis has helped clients with invisible illnesses get approved after wrongful denials. - Autoimmune Illness & LTD Denials in BC

Why conditions like lupus, MS, and Crohn’s are often misunderstood by insurers — and how to fight back.

Government & Legal Resources

- CPP Disability Toolkit – Government of Canada

Step-by-step guide to federal disability benefits, appeals, and eligibility. - Disability Tax Credit – Canada Revenue Agency

Support for Canadians with long-term disabilities, including mental health and chronic conditions.

Bookmark this page or share it with someone you care about. Getting informed is the first step to getting the support you need.

🕒 Last reviewed: by Tim Louis, Long Term Disability Lawyer in Vancouver

How Insurers Assess Cognitive Disability

Brain Fog, Memory, and Concentration Issues: How Insurers Assess Cognitive Disability By Long-Term Disability Lawyer Tim Louis Brain fog is real. It

How LTD Insurers Treat Different Medical Conditions in BC

Fact Checked by Long-Term Disability Lawyer Tim Louis Why insurers look at different conditions differently When people talk about long term disability,